New research from Morgan Stanley says that during May 2022, iPhone sales were up 15% year-over-year in China — but at the same time, App Store usage has decelerated in the country.

Investment bank Morgan Stanley has reported on the latest App Store growth before, to an extent that it could affect worldwide sales. Now the company has focused on the Chinese market , and seen similar figures for the App Store, but better news for the iPhone, iPad, and Mac.

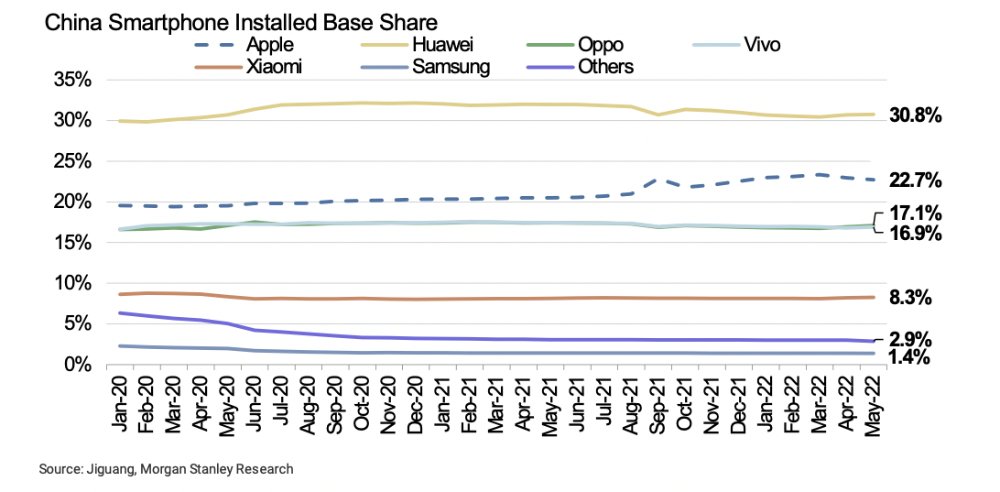

In a note to investors seen by AppleInsider, Morgan Stanley analysts say that "iPhone growth rebounded to +14% Y/Y in May." The company says this happened as "lockdowns eased," and that it led to "the 21st consecutive month of smartphone IB [Introducing Broker] share gains in China."

Looking at the monthly picture for the App Store, though, Morgan Stanley estimates only 1% growth through June to date. That compares to 6% growth across the whole of May 2022.

Morgan Stanley does not examine reasons for the App Store growth decline, which seems to run counter to the increased iPhone sales. One possible reasons for an App Store slowdown, though, is China's requirement that regulators to approve new games.

China is also limiting its issuing of licences to gaming companies. Plus, recent restrictions have imposed limits on children's time playing games.

"According to the latest disclosures from the [Chinese authority] CAICT, total smartphone shipments in China in May were 20.6M units, down 9% Y/Y," said Morgan Stanley analysts. "This was a notable acceleration from 34% Y/Y shipment declines in the month of April, as China lockdowns eased and pent-up demand was met."

"Our estimates would suggest that May iPhone shipments in China were 4.2M units, up 14% Y/Y (off a +35% Y/Y growth compare)," they continue, "while shipments for domestic Chinese smartphone vendors were down 13% Y/Y (Exhibit 21), indicating iPhone share gains in May."

Significantly, the firm reports that 11.8% of Apple users switched to a Huawei phone during May 2022, but 24.6% of Huawei customers switched to Apple. Note that Huawei had a smaller market share than Apple, so the percentages are not comparable.

What is comparable is the BP, or Basis Point, the financial term used to give some comparison between different companies. "Apple's retention rate increased 66bps [Month over Month] in May, and still remains well above historical averages," says the company.

Morgan Stanley also had news about Apple's supply chain. It reports that the easing of China's lockdowns is helping with both Apple retail stores, and production of the Mac and iPad.

"We believe the measured lifting of COVID related restrictions in China in recent weeks has aided Apple's Mac and iPad production," say the analysts. "Our Mac lead time tracker shows that the MacBook Pro M1 lead times are 56 days as of June 16th, down 6 days from the record of ~62 days the week prior."

The company at least partially ascribes the decreased lead to "better production utilization." But it's now also true that all of the region's Apple Stores are open and taking orders.

"While lead times are still ~ 2 months, this downtick is likely a sign of improving supply," continue the analysts. "The Mac Studio, which was released in March 2022, saw a similar trend, with lead times falling by 6 days week-over-week."