Article Hero Image

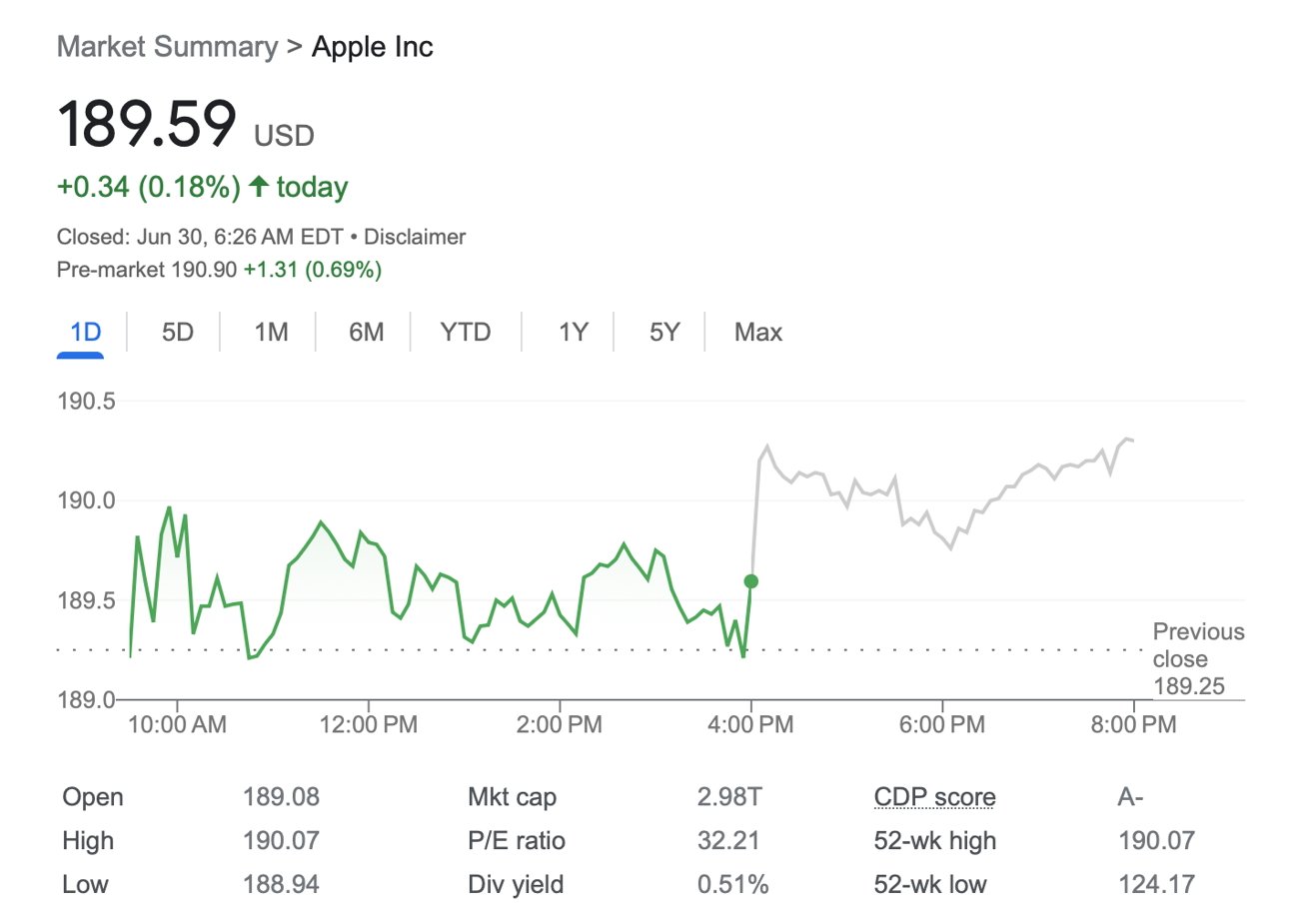

Following a flurry of overnight trading, and in the wake of the WWDC announcements, Apple has returned to a $3 trillion market capitalization.

When the NASDAQ opens, it will be official — Apple has touched $190.73 in pre-market trading, and returned to a $3 trillion market capitalization.

In January 2022, Apple became the first company in the world to be valued at $3 trillion by the market. Over the following year, however, its valuation fell to under $2 trillion after what was believed to be investor jitters.

The drop coincided with months of supply chain problems that had affected Apple's most lucrative devices. During the typically highest sales period for iPhones, for example, the iPhone 14 Pro saw huge delays because of production problems in China.

Those problems were related to COVID, though, and since the end of 2022, production has returned to normal. Plus Apple has been working to decrease its dependence on China and instead produce more iPhones in places such as India.

It has returned to this rareified air while the number of shares have been decreasing. Apple has continuously been buying back stock for the last seven years, and retiring most of it, which reduces the total number of shares available.

It is also about to roll into its most profitable period of the year. The iPhone 15 is expected in the fall, and it is also just part of a raft of products Apple is expected to release by the end of 2024.

"Apple [is] playing chess while others play checkers," said Wedbush analysts in a note seen by AppleInsider. "In FY24 the Cupertino stalwart is on pace to approach $100 billion of annual services revenue growing double digits which is a jaw dropping trajectory vs. the roughly $50 billion+ of services revenue that Apple was delivering only in FY20."

"We believe Apple's fair valuation could be in the $3.5 trillion range," says Wedbush, "with a bull case $4 trillion valuation by FY25."

Part of the reason for Wedbush's growth prediction is a belief that the App Store for the new Apple Vision Pro is "another expansion of the App Store moat down the road."

It's not clear if the market forces will sustain that $3 trillion valuation for the day, nor does the figure mean anything tangible for users that do not hold Apple stock.