![]()

If you buy through our links, we may get a commission. Read our ethics policy.There hasn't been much drama in Apple's earnings for two decades — and that's good

Malcolm Owen

|

Apple's continued annual growth makes it an investor's dream buy

Apple's commitment to design and constant evolution for the last 20 years has resulted in incredibly dull earnings even through COVID's peaks, but also phenomenal growth for its long-term investors.

Every three months, the financial fitness of major companies goes under the microscope, as analysts and fiscal pundits run the numbers and try to work out which firm is worth an investment.

In some cases, the results are a massive indicator of any given company's fortunes. For example, CNBC noted that ahead of a better than expected Q1 results, Meta's shares went from losing two-thirds of their value in 2022 but were 74% up before the release of the results.

However, that's not the case for a company like Apple. By contrast, its results are fairly predictable with relatively small changes in headline figure changes.

These minor year-on-year changes mean financial analysts have to cling onto any small change and try to justify why Apple is "failing" or "crushing it" in some way. This is all making mountains out of molehills for investor attention.

What happened in Apple's Q2 of 2023

The Q2 2023 results were, depending on how you read Apple's figures, either acceptable or a little disappointing.

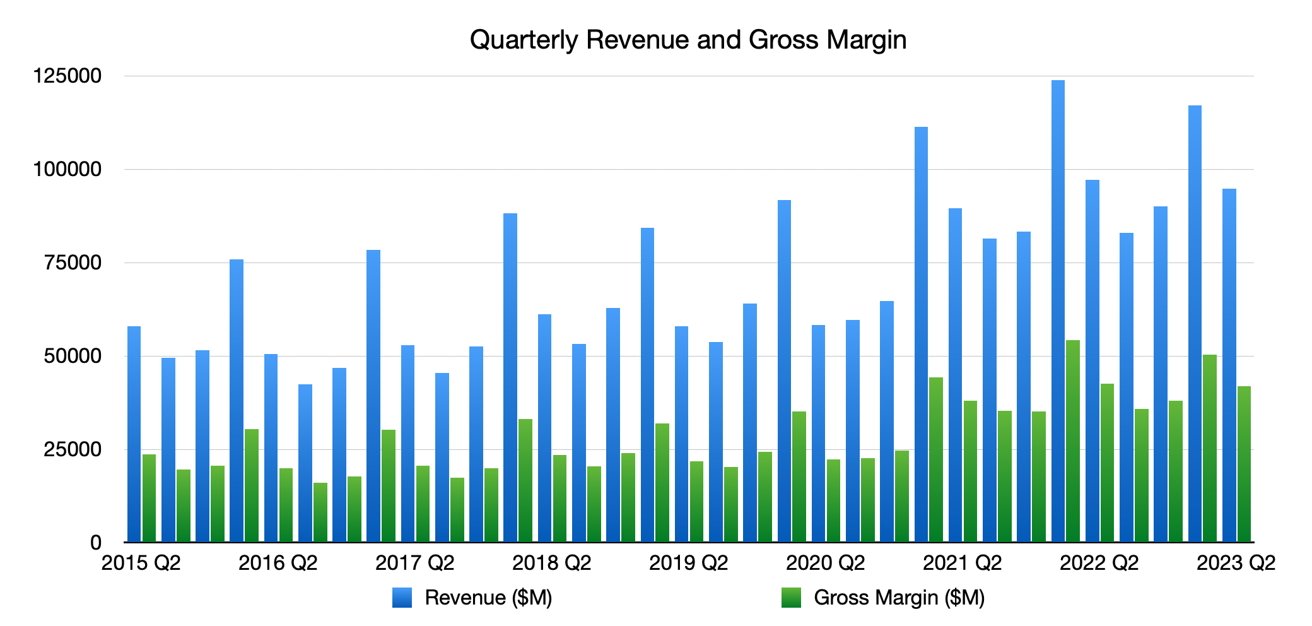

Its total revenue for the quarter ending April 1, 2023, was $94.8 billion. This is down year-on-year from the $97.3 billion reported in Q2 2022.

The pessimist will look at the difference, and see it as a drop of some $2.5 billion in revenue for the period compared to the same timeframe one year prior. To a smaller company, a $2.5 billion drop in revenue would be fatal and almost impossible to seriously recover from in most cases.

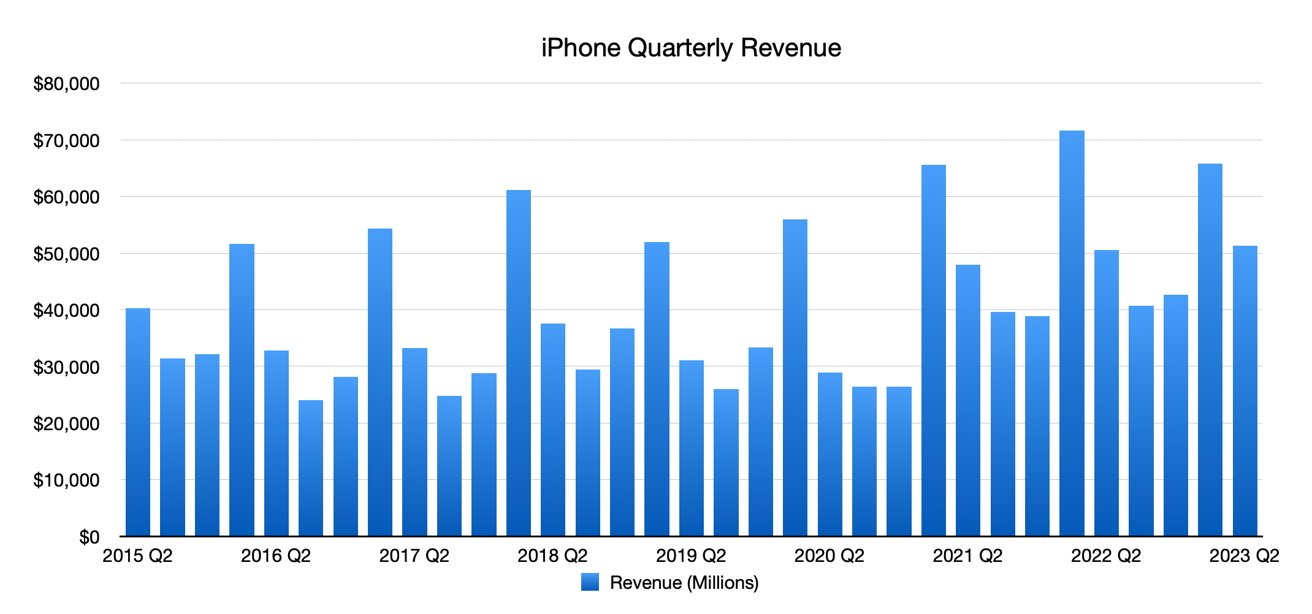

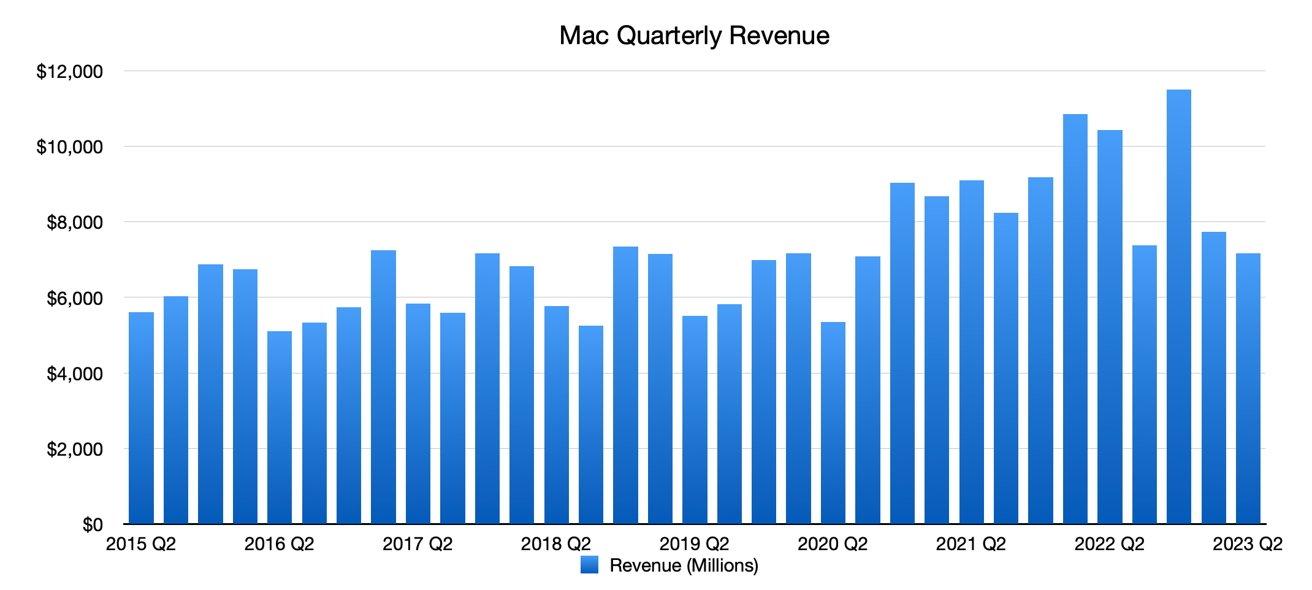

During the period, iPhone revenue rose YoY from $50.6 billion to $51.3 billion. However, Mac revenue went from $10.4 billion to $7.2 billion, and iPad revenue also went down from $7.6 billion to $6.7 billion.

For Apple, it's almost not noteworthy at all. In the year-ago quarter, it was still surfing the wave of COVID purcahses, and the new Apple Silicon MacBook Pros were still relatively new. And then, there's the new Mac Studio too.

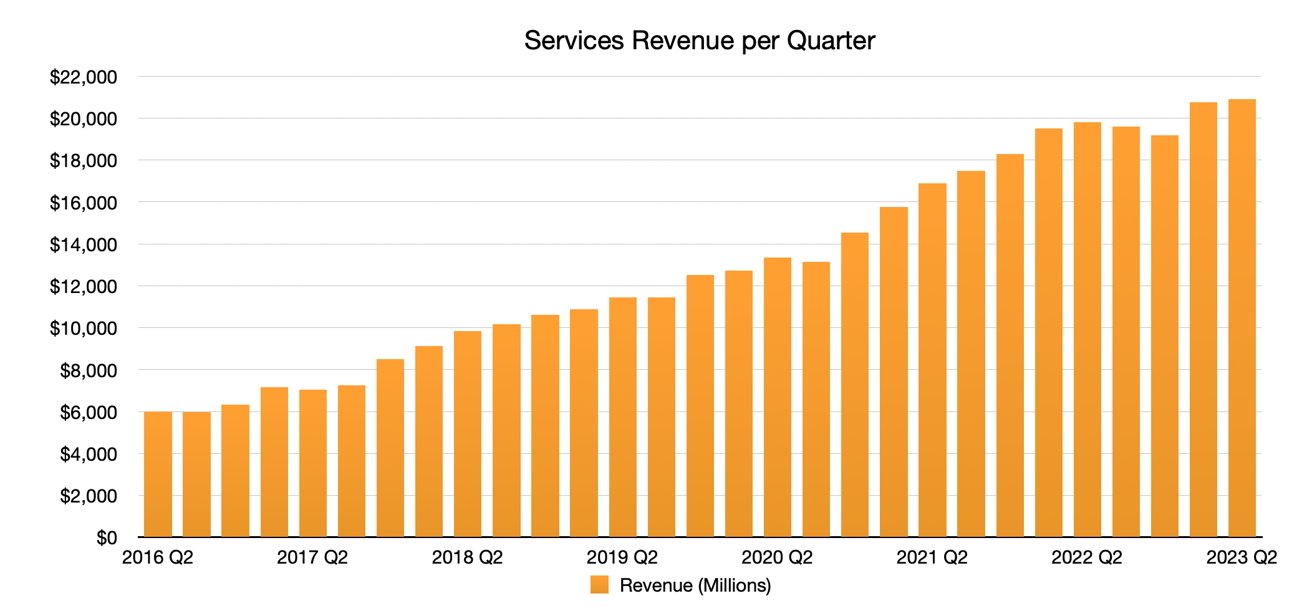

Services continued to be a point of year-on-year growth, moving from $19.8 billion to $20.9 billion, but Wearables, Home, and Accessories stayed almost level at $8.76 billion from $8.8 billion one year prior.

In discussing the figures, CFO Luca Maestro insisted the year-on-year business performance has improved compared to the December quarter, and that Apple was doing great enough to commit to another $90 billion in share repurchases.

With all of the reading in billions of dollars, these all sound like massive changes. Don't let the dollar signs blind you, as it's pretty much business as usual.

Massive size, small changes

One thing to bear in mind is that Apple is a massive company. As in rakes in more revenue in a quarter than the annual GDP of many countries.

We're dealing with stupidly large figures here that all but billionaires and high-range millionaires will truly understand beyond "That's a lot of money."

The key here is to understand it proportionately. Look at how the figures change as a percentage to see how much of a swing there is between years.

$2.5 billion down year-on-year in revenue is shocking, yes. Except as a percentage, that's just a 2.5% change.

From the optimist's side, that's not really much of a year-to-year change for Apple to worry about. Sure, it's down in revenue, it's shrinking, but not by much.

Of the other headline figures, iPhone gained $764 million in revenue, which is just 0.5%. Practically staying level.

Mac dipped $3.2 billion and iPad dropped $1 billion (really $976 million), which are swings of -31.3% and -12.8% respectively.

These seem much worse for Apple, especially knowing we're dealing with massive numbers. But at the same time, the Mac and iPad businesses are still considerably smaller than that of the iPhone's revenue.

The swings may be huge when compared to its own history, but against iPhone and the overall revenue, it's a negligible swing.

There's also potentially some concern about Services revenue, with its growth of 5.5% YoY being far from the double-digit growth of a few quarters previous. Some may consider the percentage to be a case of saturation for the segment, and that maybe the growth will turn to shrinkage at some point.

However, given that Services hauled in two to three times the revenue of Mac or iPad overall, the growth of 5.5% may be given more a meaning of success for the arm.

Taking a long-term view

There are many ways a person can invest in a company. For some, buying and selling stock can happen rapidly, as they effectively make short-term investments in a company's immediate future.

For others, like Warren Buffett's Berkshire Hathaway which owns some 5.8% of Apple stock, the long-term view is more appropriate.

Going for the long-term investment approach is one where the investor has a belief that the company will continue to do well and raise its value continuously. Not over just one quarter, but over many quarters. Even years.

It's safe to say that in the case of Apple, investors who've taken the long-term view have reaped the rewards.

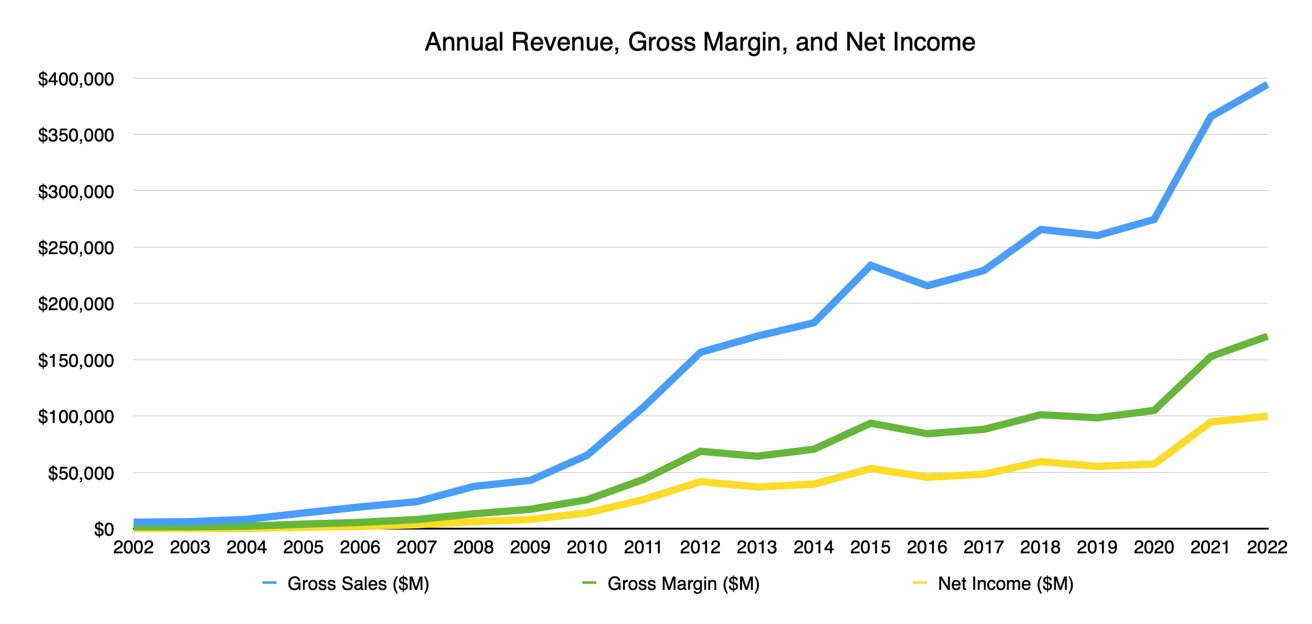

Compiling Apple's annual financial results from 2002 to 2022, you see a massive shift in sales for the company. We're talking from $5.7 billion for the full year of 2002 to $394 billion in 2022.

That's a 6767.43% upwards change in annual revenue that Apple hauls in within 20 years. That's a startling number to consider.

With that growth in revenue, investors are bound to see their investments in Apple swell in size and provide continued dividends throughout the period too. For those who believed early on that it would happen and laid their money down, it would've been money well spent.

Slow and steady wins the race

The aim of investors is to pick companies where, if you look at their important numbers, the lines on the graph go up as they go further right. Overall positive growth is what's looked for, especially for those investing for the long term.

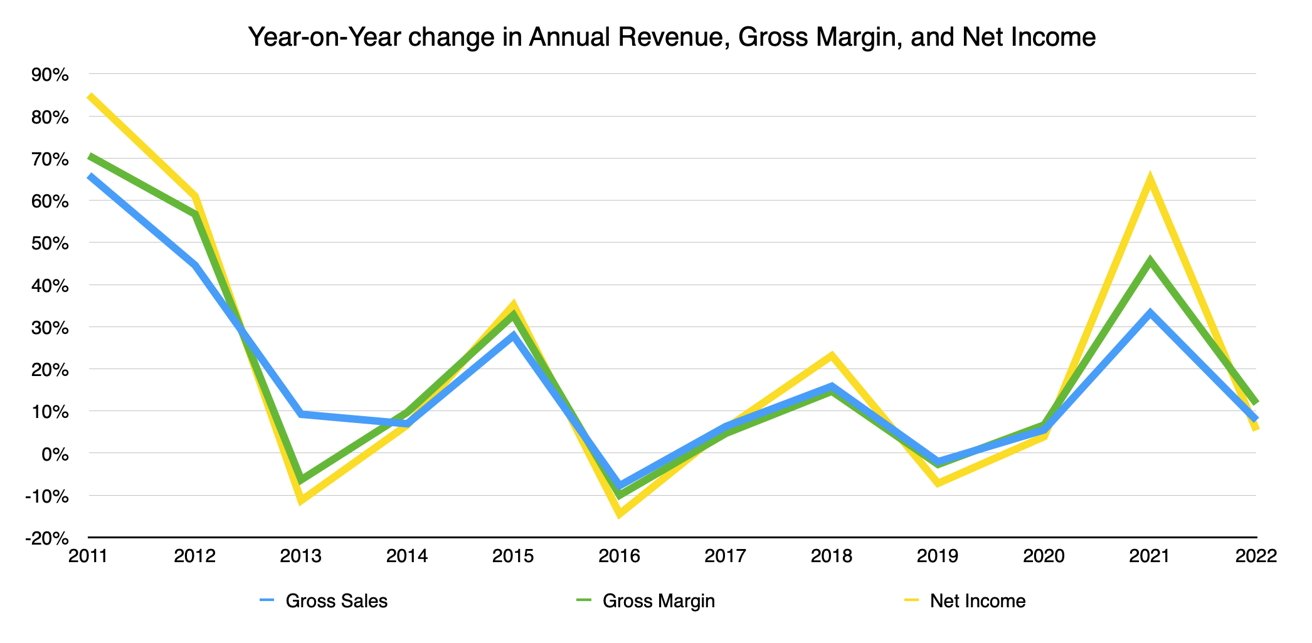

Annually speaking, Apple is an almost perfect example of this. Across the 21-year period between 2002 and 2022, Apple's gross sales only falter in two years: -7.7% in 2016, and -2% in 2019.

For all other years in that period, Apple has demonstrated reasonably high growth in annual gross sales. The peak is in 2005 with 68.3%, but with the exception of those two years, it either posted moderate single-digit growth or knocked sales out of the park with strong double-digit growth.

In the tech industry, where companies can see massive growth into billion-dollar firms and then can just as quickly fall apart, Apple is an investment exception.

By demonstrating growth almost every year over the last two decades, Apple has demonstrated itself to be an extraordinarily reliable investment vehicle. It may not necessarily be the flashy upstart, but it'll still be around and doing well when the remains of said newbie most likely get acquired.

Massive size, minimal risk

One thing that you're not going to see Apple do is any major pivots. Due to its size, it's more like a giant ocean liner than a speedboat while traveling through the water.

While the crew is keenly watching out for icebergs on the horizon, they also need to be mindful that they don't change course that much. If there are any planned changes, be it to avoid perils like App Store legislation in Europe or to seek out new opportunities like an Apple VR headset, they are calculated carefully in advance and alterations are gradually made.

Turn too sharply and the investor-passengers may not like the lack of progress or the sudden change in direction. Some may even choose to abandon ship.

The smaller startup speedboat is nimble enough to change direction on a whim, and those onboard are unlikely to be turned off by the actions. It's a smaller vessel/business, and there's far less at risk.

Ocean liner Apple has no choice but to be careful, to diligently watch the horizon for what's inbound, and to carefully plot its route.

As a trillion-dollar company, that means Apple must spend wisely on research and development and calculate what would be the best move. It takes years to move into a field, but when it does, it does so with confidence it has done enough preparation to keep the investors happy.

Apple is a boring company investment-wise. But at its size, and with trying to maintain its track record, it has no choice but to be boring.

Boring, but with Services, slowly changing

While Apple has largely stayed the course when it comes to its main product lineup, it has slowly made changes over the years to change how it is as a company.

As time has moved on, Apple has realized that it cannot rely on the iPhone's revenue if it wants to grow more. Granted, that revenue alone is massive, but there are only so many human hands you can place the iPhone into.

Back in 2015, analyst Katy Huberty of Morgan Stanley declared to investors that the growing Services business could account for 20 percent of Apple's earnings in the following years, and that rumors of a TV service could make things progress quicker.

Years later, it seems Huberty was on to something.

With continued Services growth, thanks to a flourishing App Store and the introduction of new services like Apple TV+ and Apple Arcade, Apple has given more reasons for its users to use its hardware and to stay inside the ecosystem.

Indeed, with iPhones continuing to be a commodity in the second-hand market, there is a considerably large user base for Apple to sell its services to.

During the Q2 2023 results, CEO Tim Cook revealed the Services business is nearing its billionth paid subscription. In Q1, it reached over 935 million active paid subscriptions and reported 900 million paid subscriptions in Q2 2022.

That number could grow even bigger, as in its Q1 results, Apple revealed it had two billion active devices, with each a potential target for the Services business.

For Apple, Services has grown over the years to be a hefty chunk of its revenue. It's still behind iPhone, but with the figures still continuing to rise each quarter, it's likely to get extremely close, and may end up being the most important bit of the company.

The gross margin of Apple has hovered between the high 30% and low 40% region over the last 15 years. In 2022, the gross margin percentage was 43.3%, and in Q2 2023 alone, it was 44.26%.

The key here is that, unlike making physical products like an iPhone or a Mac that have fairly low margins, the Services arm mostly deals with elements with a very high margin.

As Services continues to raise its proportional contribution to Apple's bottom line, it will help shift that gross margin figure even higher. Namely, Apple's earning more profit from what it's actually spending to make the profit in the first place, as the gross margin goes up.

Built to last

Apple has built itself into a very reliable revenue-generating machine, that most investors would be happy buying shares of, given its history. With Steve Jobs and then Tim Cook at the helm, Apple has grown to a massive size and one that is carefully managed.

It may not necessarily have the allure of brand-new technology companies that may see fantastic short-term growth in a small number of cases. It also can't easily shift itself away from the comforting revenue of its iPhone business.

Yet it is still changing as a company, as its Services business proves. It just does so at such a pace that startups can come into existence, grow, and collapse within the timeframe it takes for Apple to get going on a new course.

Apple does change, but certainly not in a way that can appease short-term investors. And not without rocking the boat too much.

To paraphrase Gordon Gekko, greed may be good, but Apple's active proof that boring is brilliant.

Malcolm Owen

Based in South Wales, Malcolm Owen has written about tech since 2012, and previously wrote for Electronista and MacNN. In his downtime, he pursues photography, has an interest in magic tricks, and is bothered by his cats.